Whatever the fault that lies behind the collateral issues at Vesttoo, the saga highlights the risk of over-extending the insurance value chain and the under-appreciated importance of carefully managing counterparty credit risk…

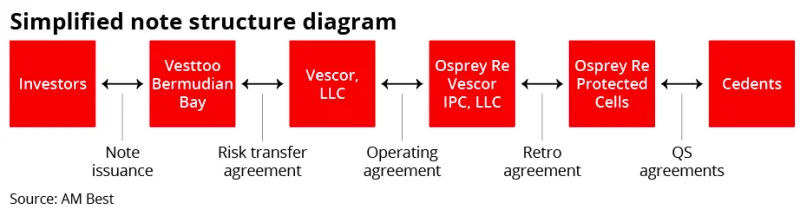

In some cases Vesttoo was transacting directly with buyers, but in the most extended version of deals where it utilised the MGA/fronting segment, the chain of transfer would include a long line of providers.

This runs from the broker to the original MGA via its fronting company connecting to reinsurers via reinsurance brokers and on to a capital markets investor base of which little is known.

The multiple steps in the process are not only going to load costs and commissions into the chain, but also damage the ability to establish the goodwill that is necessary to grease the wheels of the system.

The distance between end-client and capital makes it hard to manage difficult discussions and grey-area claims. Also, the lack of transparency and number of links in the chain creates risk around poor underwriting and weak oversight.

This holds regardless of whether this case was a sophisticated fraud that was inherently difficult to detect or a case of multiple intended defences failing.

A value chain this long and convoluted was an accident waiting to happen.

“A value chain this long and convoluted was an accident waiting to happen”

There is a case for some deconstruction of the value chain and ensuring that companies are specialising in their area of expertise and transferring on risk to the lowest-cost sources of capital.

However, this model appears to be far from an ideal solution as it exposes several key risks: 1) issues with partial collateralisation, 2) the vulnerability implicit in the fronting segment’s high levels of leverage and 3) the challenges of assigning responsibility in a fragmented value chain.

Partial collateralisations

Firstly, it is worth coming back to the inherent risk of using collateralised or unrated capacity in the primary markets, rather than traditional rated (re)insurers using their paper. Unlike the more established cat ILS market where collateral means cash collateral by and large, there are higher degrees of credit risk built into the system.

That is because cedants are required to hold collateral (which may be cash or letters of credit) against current loss reserves – not the ultimate maximum liabilities.

Fronting companies would ask for a collateral buffer above current loss reserves, typically somewhere between 120% and 150% of the reserved loss (although regulations allow it to be lower). But the front’s outwards protection may cap out at a 130%-200% loss ratio, which means – assuming the original reserved loss predictions are around a 60% loss ratio – the ultimate liability could be a multiple of 2x the current collateral levels. (Of course, the fronting company also takes back the loss above these caps – leaving them running high levels of risk for tail events.)

The letters of credit are designed to cover the risk that the ultimate investors behind the deals renege on their commitments, and the bank credit rating is merely viewed as a safeguard on that capital, rather than the ultimate bearer of the risk.

This is an industry-wide practice that is not peculiar in any way to Vesttoo or one of its partners, Corinthian Re. Other examples of carriers in this space include Topsail Re, Fergus Re and Longtail Re.

Market participants have said letters of credit have been used for many decades and if correctly verified from strong providers, should be a stable system. But the point remains that the system has vulnerabilities built into it that need to be managed.

Leverage

Similarly, the leverage of the fronting carriers works like all leverage to multiply returns in the good times, and to exaggerate losses in the bad times.

If fronting companies or hybrid fronts operate with counterparties that are poorly vetted, or where there is a lack of willingness to pay on loss-making deals, they would be left with losses that are outsized for their balance sheets.

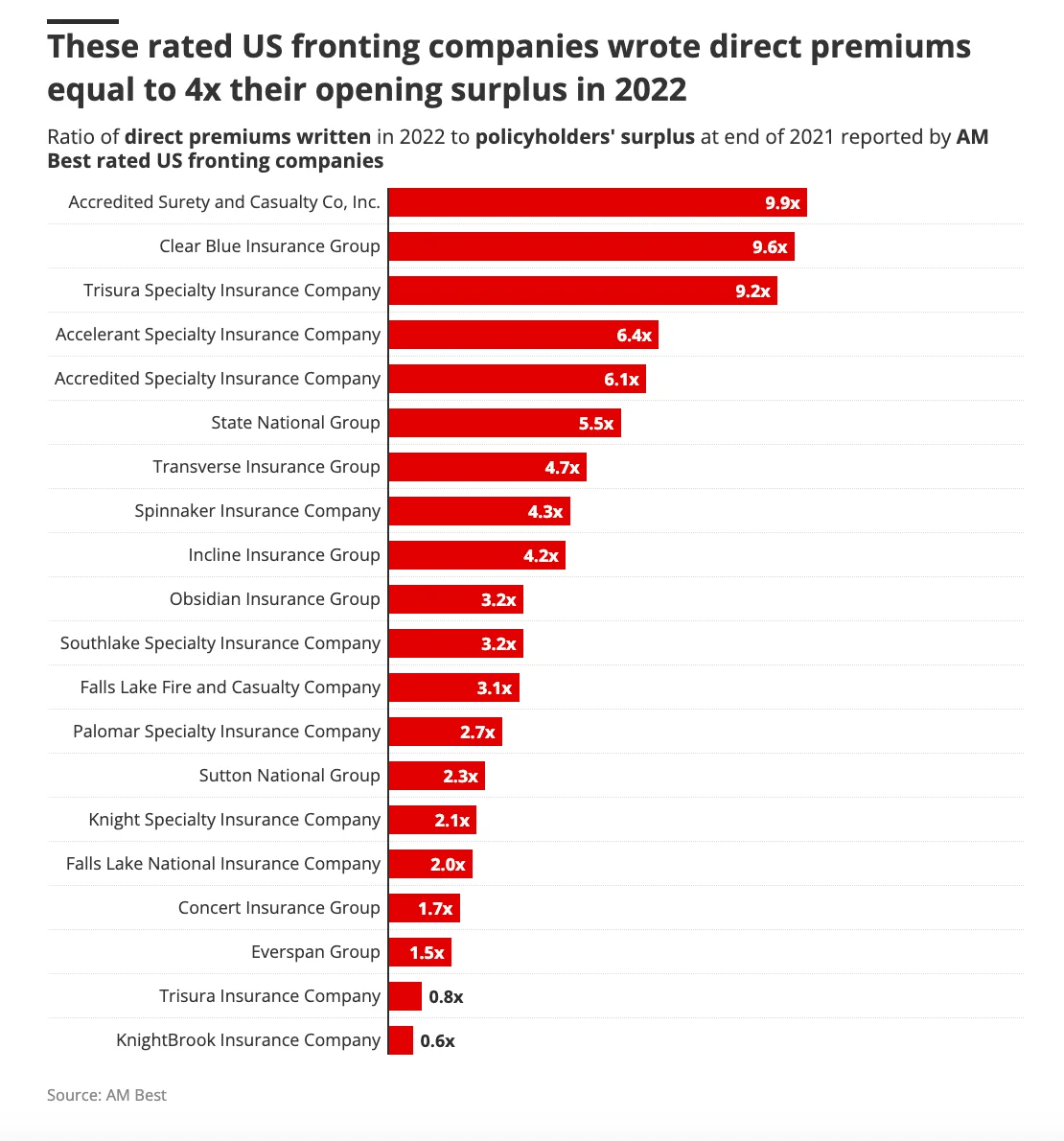

Fronting carriers can be writing close to $10 of premium for every $1 of their own capital – 10:1 leverage is incredibly high. And it only works because 80%-90% of non-tail risk is being ceded.

Should any of these companies suddenly find they are unreinsured on a specific program, they could find themselves either over-levered and so without sufficient capital to support their rating, or impaired if the portfolio turns out to be heavily loss-making.

With that said, fronting market carriers have pointed to the cushioning impact of retaining premiums that they were ceding to unrated carriers – meaning that loss experience would have to deteriorate before they needed to call up letters of credit.

But this will clearly be a public relations headwind for the sector, with the onus on players to show how they are delivering on credit checks.

Sister title Inside P&C argued in a piece last year that the use of collateralised reinsurance was a fault-line in the MGA market that could be exposed over time, and also called attention to the risks inherent in the fronting model.

Assigning responsibility in the value chain

Along with the elongated value chain comes the high likelihood of disputes and litigation in all directions for failure to pick up the alleged fraud with the potential for messy E&O claims.

Market participants discussing the news admitted that sophisticated fraud is by its nature hard to detect. But they also raised questions over how multiple checkpoints that are designed to safeguard collateral security could have let this slip through.

The letters of credit should have been checked out by fronting companies, while know-your-client checks of the ultimate investors should have been done by those offering up the capacity, including brokers.

“Frankly, you can’t set yourself up as an intermediary between risk and capital, and then not take a view on the capital at all”

Vesttoo’s role in this is somewhat opaque, as it has been cautious to present itself as an intermediary or risk modeller that connected investor capital to cedants – not a fund manager that had taken in ultimate cash or was responsible for the capital.

But, frankly, you can’t set yourself up as an intermediary between risk and capital and then not take a view on the capital at all.

And if you are just another intermediary, where is the value in that offering, which seems to be a kind of unvetted introduction service, for brokers and cedants?

Vesttoo’s aim had been to work towards sourcing capital through its planned cat bond as an extra source of value, but this never came to fruition (and the list of risk factors in the deal’s complex structure, as we covered, may go some way to explaining why).

If it were to demonstrate value purely on the tech or modelling side of the equation for investors or risk-takers, over time it would need to show that this stands up as a service in itself – and even then this is a thin offering to say the least.

On its pitch to trading counterparties, this collateral issue could quickly create a major access-to-business problem for it if not remedied very quickly, to state the obvious.

Clearly, some market participants were cautious enough of trading with the letters of credit providers offered by Vesttoo that they were willing to walk away from their trades, despite brokers saying their capacity was priced below market levels.

Those that do have cover from the firm that is backed by problematic LOCs will clearly be looking to verify and likely probably swap out their “security” as fast as possible.

It has been a long time since the (re)insurance industry has had a major shock in terms of impairment of credit ratings – the last time was in the financial market crisis of 2008, involving companies with much greater standing than unrated providers.

This is a salutary reminder that credit quality matters and that not all capital is created equal.

Related posts:

RISK ADVISORY: Tigermar developed a bespoke solution to support client's growth

RISK ADVISORY: Tigermar’s claims advocacy made all the difference.

RISK ADVISORY: Tigermar works with partners like CyberOwl to help clients strengthen resilience and ...